Think cashflow, not accounting expenses

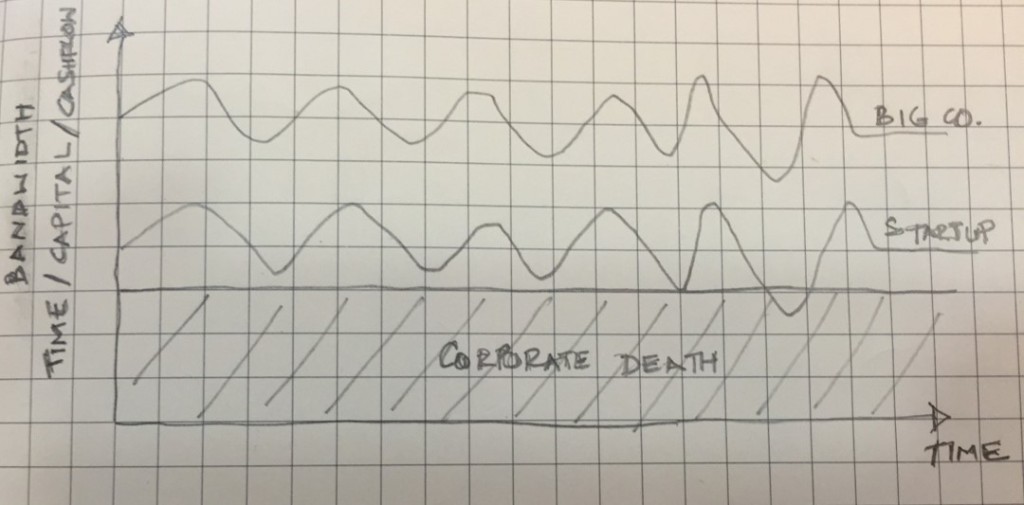

For a startup, it usually hurts to think like an MBA or an accountant. While an MBA analysis (or typical big company analysis) would make you look at costs and revenues on an accrual basis and suggest ways to grow and maximize profitability, for a startup you need to always think cashflow. Money in, money out. So, a rental deposit is not an asset that can be excluded from your expenses (based on accounting values), it is an immediate cash outflow that must be recognized as such. To take this to an extreme, purchasing assets with periodic payments rather than a lumpsum upfront payment, may make sense even if the interest rate on the periodic payment is high. The (first) goal of a startup is to stay in business. As long as possible. Managing on a purely cash basis allows you to stay in business longer, which allows you more of a chance to validate your business plan.

Hire a Chartered Accountant, preferably with a part-time Company Secretary who is experienced in working with small businesses

The laws pertaining to company formation, company compliance and basic capital issuance for all companies (including startups) are quite complicated and are unfortunately wrapped in clouds of secrecy. I was not, and am still not, aware of any comprehensive sources or websites one can go to in order to figure out how to comply with laws related to company law and capital issuances. To highlight some simple points that most people don’t know – are you aware that shares issued by a startup to an investor at a price higher than par value (which is almost always the case) can be treated as taxable income in the hands of the Company, unless the Tax Assessing Officer is satisfied that the price is “fair”? It’s a strange rule, meant to curtail the use of private companies to funnel black money. But unfortunately, it serves as a painful rule for honest startups that would necessarily need early-stage capital to get off the ground. Most people don’t know these kinds of rules. Need a tax/accounting/company law professional to quickly advise you on these matters

“Be Indian, Buy Indian”

This is not a xenophobic comment, nor do I think that you need to be patriotic and shun foreign products. However, given that the biggest constraint for a startup is usually time and the fact that our foreign exchange laws in the country are extremely limiting, you are better off dealing only with locally-registered companies. Payments to foreign entities have a whole different set of rules which usually require professional advice and slow you down. For example, did you know that for a startup cannot just swipe a credit card and pay for Facebook For Business? Or LinkedIn? Both of those companies have foreign entities that are the contracting entity for Indian customers. As a corporate customer, you need to get a Chartered Accountant to issue you a tax document in advance (called a 15CB), you have to deposit TDS and then remit payment. Apart from the cost of getting a Chartered Accountant’s certificate (usually costs upwards of Rs.1500 per event), it’s the hassle of doing all this just to make what sometimes is a payment of a few thousand rupees.

If raising external capital, try to raise it domestically and not raise Foreign Direct Investment (FDI)

While the rules relating to FDI have been eased substantially over the years, there is still a lot of paperwork and bureaucracy in dealing with foreign investment. The RBI has delegated a large part of their exchange control roles to banks who serve as authorized dealers. This ought to be good, as it reduces the number of times you have to approach the RBI for approval. However, most banks (I have dealt with three till date) have internal rules and controls that are more stringent than what RBI specifies. That means you often end up with a situation where the bank’s compliance department will not process your payment even though you are compliant with RBI rules. I have once had to wait 2+ weeks (and go through a real run-around) after a wire was made to us for the funds to credit into our account. Tread carefully.

If raising external capital at an early stage, don’t worry too much about valuation

If your business needs external capital to survive and grow, it likely needs it in a relatively defined timeline. In that instance, you are better off trying to raise capital quickly on reasonable terms rather than slowly on great terms. Best to get fund-raising over and done with as quickly as possible. In the grand scheme of things, valuation levels at a startup are within some rough ranges anyways and time is your most valuable commodity so focus on getting your business off the ground and not squeezing the last bit of valuation out.